ANN ARBOR, Mich. (November 16, 2021) — Americans’ dissatisfaction with most financial services has halted – at least for now.

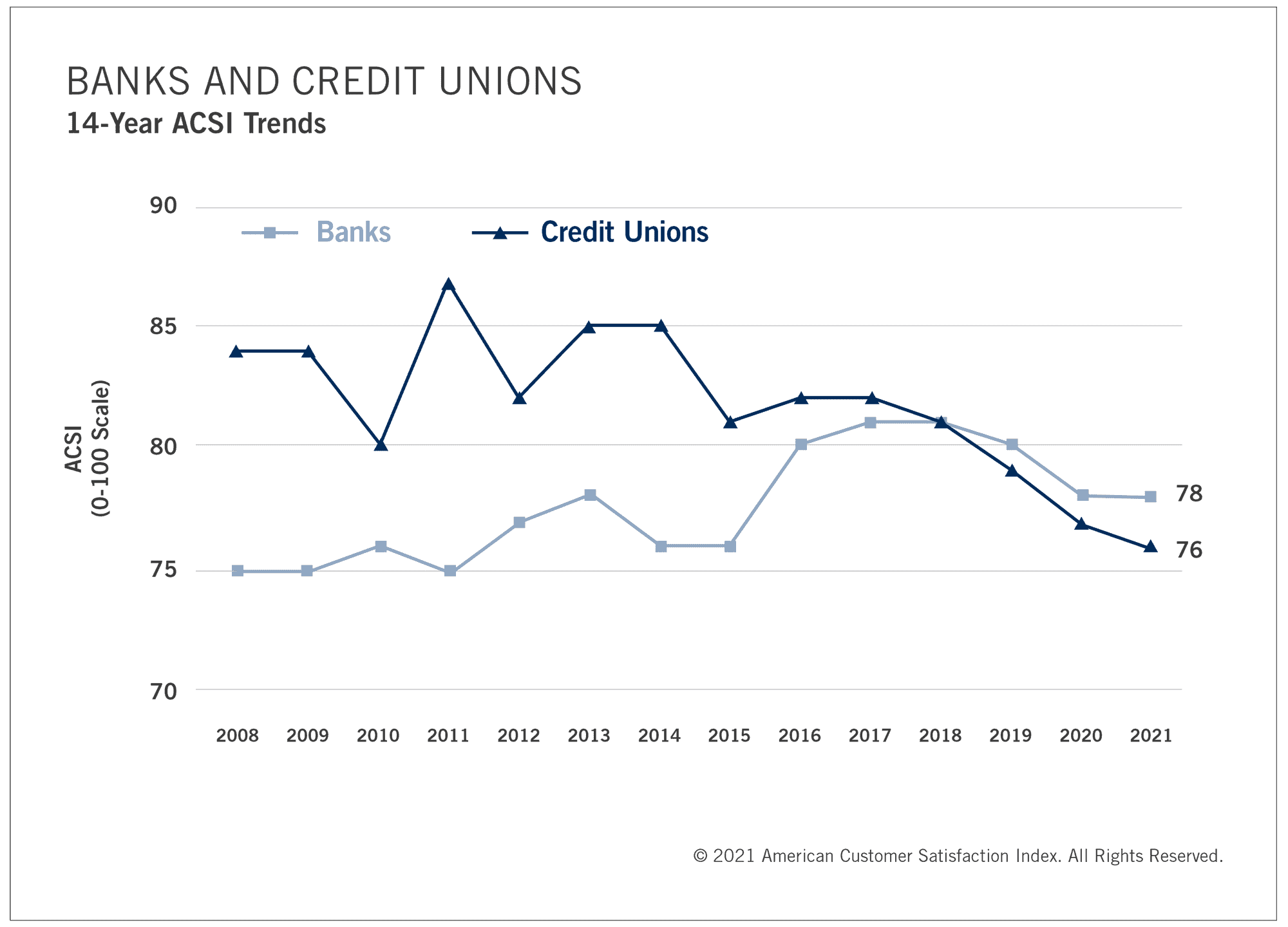

According to the American Customer Satisfaction Index (ACSI®) Finance Study 2020-2021 – which provides customer satisfaction benchmarks for banks, credit unions, financial advisors, and online investment – satisfaction with banks overall is stable at an ACSI score of 78 (out of 100), beating credit unions (down 1.3% to 76) for the third consecutive year.

Following a dramatic downturn last year, customer satisfaction with the online investment category is steady at 78, while financial advisors rebound slightly, up 1.3% to a score of 78.

“Financial services took a hit in the eyes of consumers last year but managed to weather the storm for the most part,” says David VanAmburg, Managing Director at the ACSI. “Banks, in particular, are better positioned than most because of the industry’s years of commitment to – and investment in – digital offerings. Whether paying bills, transferring money, or checking your balances, banking has established itself as a super digital-focused enterprise that’s managed to successfully cater to a digitally engaged consumer base.”

Regional and community banks continue to outperform national and super regional institutions

Among banks, regional and community institutions still lead the way despite slipping 1.2% to 80. National banks are unchanged at 76, followed by super regional banks with a steady score of 75.

Chase and Citibank remain tied for first place among national banks, both unchanged at 77. Bank of America inches up 1% to 76, while Wells Fargo dips 1% to 74, marking its fifth straight year in last place.

Capital One leads super regional banks, climbing 1% to 78. PNC Bank and TD Bank are next in line, both steady at 76. Truist, formed by the merger of BB&T and SunTrust, debuts with an ACSI score of 75, tying both Regions Bank (down 1%) and U.S. Bank (unchanged).

Near the bottom of the category, Citizens Bank (down 1%) and Fifth Third Bank (up 1%) score 74 each. KeyBank sits in last place despite a 1% uptick to 73.

Vanguard stakes its claim atop online investment

Vanguard tops the online investment industry following a 1% bump to 80. Fidelity also improves 1% to an ACSI score of 79.

Customer satisfaction with the group of smaller online investment firms is unchanged at 77, tying Edward Jones, up 1%.

Charles Schwab takes the biggest hit, stumbling 4% to 76, the same score as E*Trade (up 1%). Merrill Edge (Bank of America) is stable at 75.

In its first year of measurement, Robinhood lands at the bottom of the category with an ACSI score of 71.

Fidelity distinguishes itself among financial advisors

Fidelity takes sole possession of the industry’s number-one spot, climbing 3% to 81. Charles Schwab and Wells Fargo each improve 1% to 80 and 79, respectively, followed by Merrill (Bank of America) and Morgan Stanley, both up 1% to 78.

After sharing the lead last year, the group of smaller advisors tumbles 3% to 77, equaling UBS (up 1%). The group of independent advisors (up 1%) and Raymond James (unchanged) each score 76, just ahead of LPL Financial, which finishes last despite inching up 1% to 75.

The ACSI Finance Study 2020-2021 is based on interviews with 15,120 customers, chosen at random and contacted via email between October 5, 2020, and September 30, 2021.

This press release is also available in PDF format.