ANN ARBOR, Mich. (August 25, 2020) — The U.S. automobile industry, like the economy at large, couldn’t escape the crosshairs of the COVID-19 global pandemic. But that’s not the only hurdle the industry has to overcome: New data indicate an ongoing, industrywide customer satisfaction decline.

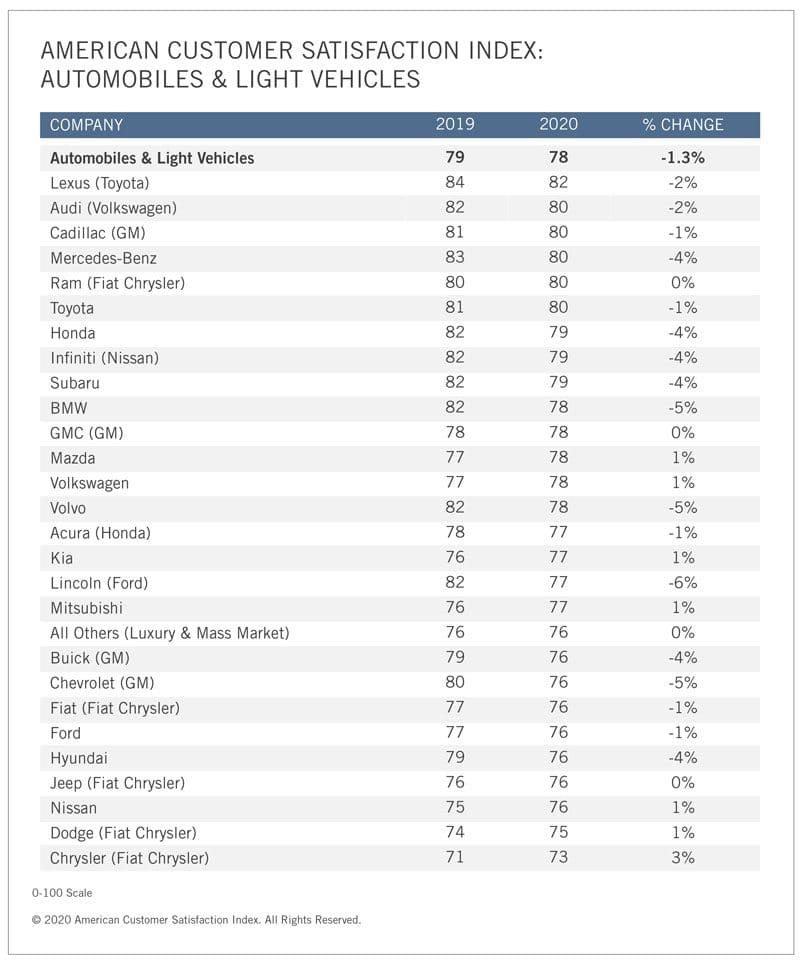

Overall customer satisfaction with automobiles and light vehicles slides 1.3% to a score of 78 (out of 100), and 17 brands post downturns year over year, according to the American Customer Satisfaction Index (ACSI®) Automobile Report 2019-2020.

Customer satisfaction decreases across all automakers – both foreign and domestic – for the second straight year and now sits at its lowest level in five years. European manufacturers hold their lead over Asian and U.S. cars despite a two-point downturn to 79. U.S. automakers also fall two points to 76, trailing European cars by the same gap seen in 2019. Asian manufacturers slip just one point to 78.

“The drop in satisfaction was more alarming a year ago, with 21 of 27 nameplates registering ACSI declines, but this ongoing slide pulls the auto industry into uncharted waters,” said David VanAmburg, Managing Director at the ACSI. “After a 4.9% customer satisfaction drop over the last two years, automobiles and light vehicles hit an industry low not seen since 1999 and far below the peak score of 84.”

Ram holds steady, ties Toyota atop mass-market sector

Customer satisfaction with the mass-market segment fades again, down 1% to an ACSI score of 77. Just under half of the measured brands show declines year over year.

Ram makes its first appearance at the top of the mass-market list with a steady score of 80, tying Toyota, which dips 1%.

Honda and Subaru tie for second place despite each retreating 4% to 79. For Honda, this score represents a record low, while Subaru matches its low point. However, Subaru continues to be number one for safety among mass-market vehicles.

GMC, unchanged at 78, ties for third place with Mazda and Volkswagen, which inch up 1% each. Kia and Mitsubishi also climb 1% a piece to 77.

A large group of mass-market plates are deadlocked with scores of 76, with three brands sustaining substantial declines: Buick (down 4%), Hyundai (down 4%), and Chevrolet (down 5%).

The remaining brands at 76 show little or no change year over year. Jeep holds steady. Nissan climbs 1%. Both Fiat and Ford slide 1%.

Two Fiat Chrysler plates round out the industry’s bottom. Dodge sees a 1% uptick to 75. Chrysler surges 3% to 73, yet remains in last place with its second-worst satisfaction score ever.

Lexus leads luxury vehicles for fourth straight year

Luxury nameplates lose their luster as customer satisfaction deteriorates with every measured brand. The segment backtracks 4% to an ACSI score of 79.

Despite falling 2% to 82, Lexus leads all luxury vehicles for a fourth consecutive year. Nevertheless, this score marks an all-time low for the brand.

Three luxury cars tie for second place with scores of 80: Audi (down 2%), Cadillac (down 1%), and Mercedes-Benz (down 4%).

Four nameplates stumble into the upper 70s. Infiniti tumbles 4% to 79. BMW and Volvo each plummet 5% to 78 – a record low for both brands.

Acura and Lincoln tie for the lowest score in the luxury segment at 77. While Acura dips just 1%, Lincoln plunges 6% to a record-low mark.

The ACSI Automobile Report 2019-2020 covering both domestic and foreign automobile nameplates is based on interviews with 10,414 customers, chosen at random and contacted via email between July 1, 2019, and June 14, 2020. Download the full report, and follow the ACSI on LinkedIn and Twitter at @theACSI.

This press release is also available in PDF format.