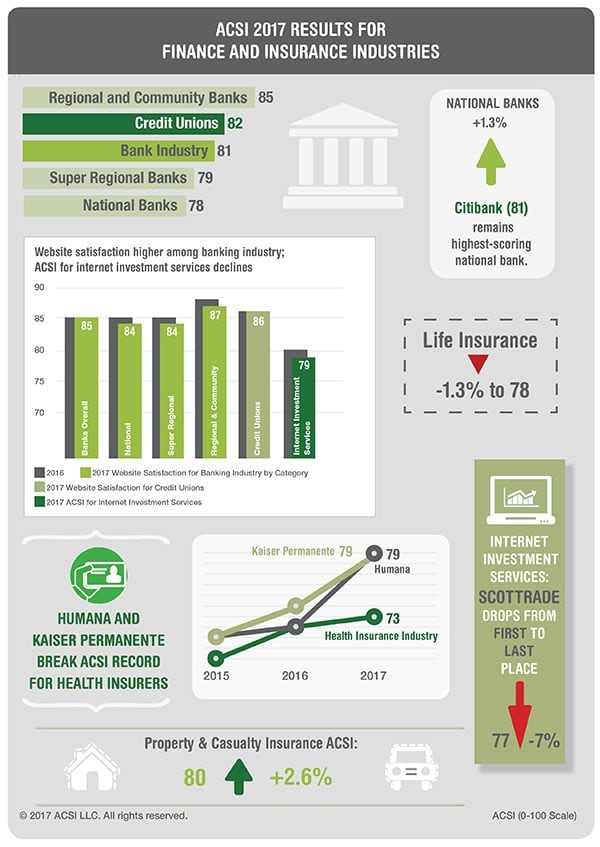

ANN ARBOR, Mich. (November 14, 2017) — New data released today show customer satisfaction with banks is at an all-time high. The American Customer Satisfaction Index (ACSI®) Finance and Insurance report covers banks, credit unions, health insurance, property and casualty insurance, life insurance and internet investment services.

Customer satisfaction with finance and insurance overall is up 0.9 percent to an ACSI score of 77.2 on a 100-point scale. Retail banks climb 1.3 percent to 81, closing in on credit unions, which are unchanged at 82.

“Digitalization is a major factor in the success of retail banks,” says Claes Fornell, ACSI Chairman and founder. “As for the future of banking, firms that best match technology with customer needs will be big winners; those that don’t will face existential threats.”

Banks

Regional and community banks improve the most, up 2.4 percent to 85. National banks rank lowest, but gain 1.3 percent to 78. Steady at 79, super regional banks are in the middle, both in terms of size and service.

Citibank remains the highest-scoring national bank despite slipping 1 percent to 81. In second place, Chase gains 5 percent to 79, the biggest improvement of any individual bank. Chase’s investments in its website, mobile banking, peer-to-peer payment services and ATMs have all helped boost the bank to its highest ACSI score ever.

Bank of America also continues to adopt emerging technology, climbing 3 percent to 77. Its customers use digital banking more than any other channel. Meanwhile, Wells Fargo continues to struggle, falling 3 percent to last place at 74.

With an ACSI score of 81, Regions Bank (+4%) is best among super regional banks. Just below, five banks tie at 80: U.S. Bank (+4%), TD Bank (+1%), BB&T (-2%), Capital One and SunTrust Bank (both unchanged). PNC Bank is unmoved at 78.

The lowest-scoring banks register declines. Citizens Bank (-4%) comes in at 77, followed by Fifth Third Bank (-6% to 76) and KeyBank (-6% to 75).

Health Insurance

November marks the fifth annual season for Americans to purchase health care insurance under the Affordable Care Act (ACA). In a second year of improvement, health insurance is up 1.4 percent to 73. According to ACSI data, policyholders with individual plans are more satisfied than those with group plans (ACSI score of 75 vs. 72).

Large gains for Humana (+10%) and Kaiser Permanente (+7%) boost the firms into a dead heat for the lead at 79. This is the highest level of customer satisfaction ever achieved by health insurers in the history of the ACSI. However, the two companies have set divergent courses with respect to the ACA: Humana is out, Kaiser will stay. Along with shifting away from the ACA exchanges, Humana announced the termination of its planned merger agreement with Aetna.

Smaller insurers improve (+3%) to a combined score of 75, overtaking Aetna (-1% to 74). UnitedHealth is up 4 percent to 73, followed by Blue Cross and Blue Shield (which includes Anthem), stable at 71. Cigna, whose merger with Anthem stalled out, remains at the bottom of the category, down 1 percent to 66.

Property and Casualty Insurance

During one of the worst hurricane seasons in U.S. history, insurers rose to the occasion. Customer satisfaction with property and casualty insurance is up 2.6 percent to 80. All but one of the largest insurers post gains.

AAA holds the lead (+1% to 82). The rest of the industry is close behind. Farm Bureau improves the most (+8% to 80). Also at 80 are GEICO (+3%), Liberty Mutual (+4%), Travelers (+4%) and the combined score of all other, smaller insurers (+1%).

American Family, Farmers and State Farm each gain 3 percent to tie at 79, while Allstate and Progressive both rise 1 percent to 78. Nationwide is the only insurer to deteriorate (-4% to 76).

Life Insurance

Customer satisfaction with life insurance slips 1.3 percent to 78. Northwestern Mutual and Thrivent Financial buck the trend, moving up to tie for first place at 83. Northwestern Mutual (+5%) is the most improved, and Thrivent’s 2-percent gain places the insurer at its highest ACSI score yet.

Most of the remaining large life insurers show stagnant or deteriorating customer satisfaction. Mutual of Omaha (-1%) matches New York Life (-2%) at 80, while Allstate falls (-4%) to meet State Farm (unchanged) at 79.

Prudential and MetLife are the only other providers to improve (+1% each) to 78 and 77, respectively. Farmers drops (-4%) to match smaller insurers (-3%) at 77. Lincoln Financial is unchanged at 76, followed by Primerica (-1%) at 74.

Internet Investment Services

Customer satisfaction with internet investment services is down 1.3 percent to 79. Only two of the large online brokerages post gains.

The biggest winner is Vanguard, which is up 1 percent to 82. The gain solidifies Vanguard’s lead over the next three firms, which shared second place with Vanguard a year ago. Charles Schwab, Edward Jones and Fidelity drop 1 percent each and tie for second place at 80. TD Ameritrade is the only other firm to post a gain (+1%), deadlocked with E*Trade (-1%) at 79.

Smaller online brokers dip just below the industry average (-1% to 78). Scottrade, which has been acquired by TD Ameritrade, falls from first to last place with a 7-percent decline to 77. It’s been a difficult year for Scottrade, with 11 months between the purchase announcement and completion of the sale. But Scottrade is not alone at the bottom; Merrill Edge sinks 3 percent, greeting the past leader at the low end of the category.

The ACSI report, which is based on 17,861 customer surveys collected between October 1, 2016, and September 16, 2017, is available for free download.

This press release is also available in PDF format.