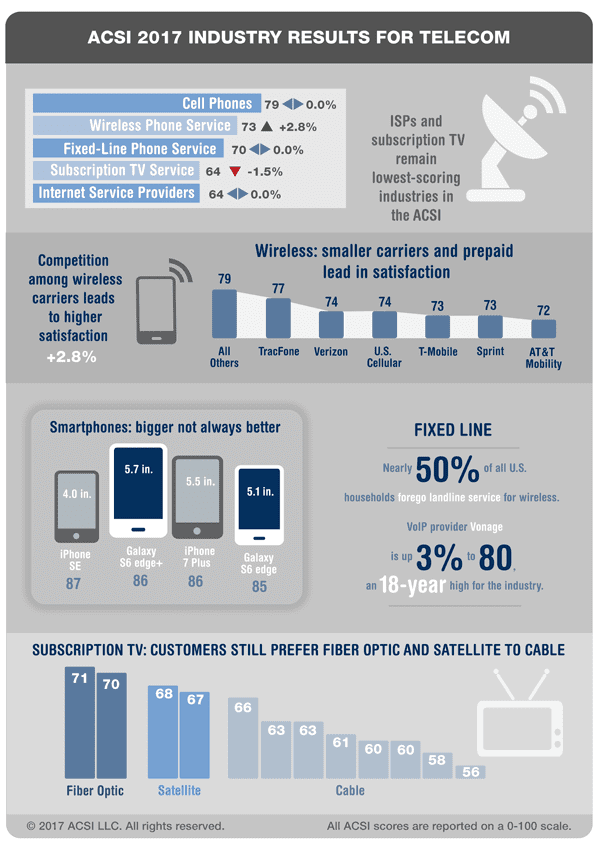

ANN ARBOR, Mich. (May 23, 2017) — Customer satisfaction with subscription television is down 1.5 percent to 64, tied with internet service providers for last place among 43 industries tracked by the American Customer Satisfaction Index (ACSI). New ACSI results show that wireless service is the only telecom industry to improve. Internet service providers, fixed-line telephone and cell phones are unchanged, while pay TV is the only industry to deteriorate.

“The threat of competition does not appear to be encouraging improvement fast enough for pay TV,” says Claes Fornell, ACSI Chairman and founder. “Customer service remains abysmal, and viewers are continuing to switch over to streaming services with much higher customer satisfaction. More than half a million subscribers defected from cable and satellite providers during the first quarter – the largest loss in history.”

Subscription Television Service

Customers still prefer fiber optic and satellite to cable, putting Fios (Verizon Communications) in first place (up 1% to 71). AT&T takes the next two spots with U-verse (+1% to 70) and DIRECTV (unchanged at 68). DISH Network is the lowest-scoring satellite provider at 67, while Optimum (formerly Cablevision Systems and now part of Altice USA) is the highest-scoring cable provider at 66. Suddenlink, which is also part of Altice USA, advances 2 percent to 63.

Spectrum (Charter Communications) is the most improved (up 5% to 63) due in part to its merger with high-scoring Bright House Networks. Cox Communications advances (+3% to 61), just ahead of Time Warner Cable (TWC) – now part of Charter Communications– up 2 percent to 60. This is the last year of ACSI measurement for TWC before they are rebranded as Charter Spectrum in 2018. Frontier Communications – having acquired fiber optic service in California, Texas and Florida – debuts in the ACSI at 60, tied with TWC. Meanwhile, Xfinity (Comcast) tumbles 6 percent to a score of 58. Despite a 4-percent improvement to 56, Mediacom remains the lowest-scoring pay TV provider.

Cellular Telephones

Cell phone technology has not changed much during the past four years, and customer satisfaction is unmoved at 79. Cell phones rate well compared with the four telecom industries, but most other consumer electronics score higher. To some extent, this is the result of high consumer expectations for mobile phones.

Apple is still in the lead among cell phone manufacturers with an ACSI score of 81. It has been nearly two years since Microsoft Mobile (Nokia) introduced a new Windows phone, but the Windows operating system appears to have withstood the test of time as Microsoft Mobile surges 8 percent to 80, tying Samsung for second place.

Despite problems with faulty batteries that caused fires in some devices, Samsung is steady at 80. The problems were limited to the Note 7, which was only on sale for two weeks before being recalled, and thus are not captured in this data. Galaxy S8 and S8+ were released at the end of data collection and are not reflected in Samsung’s score. HTC (+1%) ties with Motorola (-1%) at 76, while the combined score of smaller manufacturers (+3% to 75) overtakes LG (flat at 74).

This year, the top smartphone brand is the 4-inch iPhone SE at 87. The Galaxy S6 edge+ ties the iPhone 7 Plus in second place (86), while the Galaxy S6 edge takes third (85). Motorola’s Moto G and the LG G4 trail behind with scores of 75 and 73, respectively. The lowest-rated model, however, belongs to Samsung – the Galaxy Core Prime (70).

“Over the past few years, the general trend for smartphones has been toward larger screens,” says ACSI Managing Director David VanAmburg. “But apparently, consumers were craving a new iteration of a smaller, less expensive phone as the iPhone SE – Apple’s first update to a 4-inch phone since 2013 – comes in first in ACSI this year.”

Wireless Telephone Service

Customer satisfaction with wireless service climbs 2.8 percent to 73 as price wars between carriers escalate. Compared with other telecom categories where customer choice is limited, the wireless industry is a good example of how competition benefits consumers. Prices are competitive, service is better and customer satisfaction higher.

Smaller wireless carriers lead (up 3% to 79). Prepaid provider TracFone Wireless, which acquired Walmart Family Mobile from T-Mobile last year, gains 3 percent to 77. Verizon Wireless rises 4 percent to match U.S. Cellular (+3%) at 74. In a second year of improvement, Sprint reaches an all-time high (+4% to 73). T-Mobile ties with Sprint, but moves in the opposite direction (-1%) to match the industry average (73). AT&T Mobility is at the bottom of the category (+1% to 72).

Internet Service Providers

Internet service providers remain unchanged at the bottom of the ACSI industry rankings at a score of 64. Low user satisfaction is the result of slow and unreliable service, compounded by limited competition.

Verizon’s fiber optic service Fios stays at the top of the category (-3% to 71), but AT&T’s U-verse fiber optic service narrows the gap considerably (+8% to 69). In third place, Optimum slips 1 percent to 68. Suddenlink climbs 8 percent to 66, having significantly improved speed from a year ago. Spectrum also increases satisfaction (+3% to 65).

The rest of the ISPs fall below the industry average. The combined score for smaller providers deteriorates 2 percent to 63 and Charter’s Time Warner Cable plummets 6 percent to tie Cox Communications at 62. Comcast’s Xfinity improves 2 percent to 60 – a four-year high for the company. Mediacom gains 2 percent to 58. Moving in the opposite direction, CenturyLink declines 6 percent to 59, while Windstream slides 3 percent to 57. Frontier Communications is flat at the low score of 56.

Fixed-Line Telephone Service

Customer satisfaction with fixed-line telephone service is flat at 70 as nearly half of all U.S. households do without landlines in favor of wireless phones. Individual company performance, however, is mixed. According to users, VoIP calling is the preferred mode of landline-based communication. Vonage, a VoIP provider, is up 3 percent to 80 – an 18-year high for the entire industry. In distant second place, the group of smaller fixed-line service providers recovers (+4% to 75) and Verizon edges up 1 percent to 73. Spectrum leaps 9 percent to 71 following its merger with historically high-scoring Bright House Networks. Two companies join Spectrum at 71: AT&T and Optimum.

Below industry average, Cox Communications is unchanged (68), while Time Warner Cable moves up (+5% to 67). CenturyLink declines (-3% to 66), followed by Xfinity (+2%) and Windstream at 65. Frontier Communications deteriorates the most (-9% to 61).

The ACSI report, which is based on 36,194 customer surveys collected between May 17, 2016, and April 25, 2017, is available for free download.

This press release is also available in PDF format.