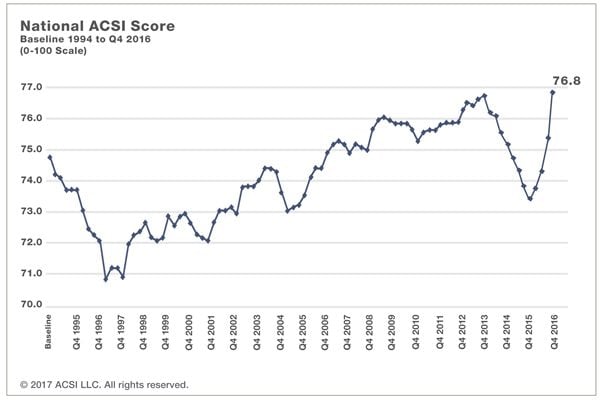

ANN ARBOR, Mich., (April 13, 2017) — The national level of customer satisfaction exhibits strong growth as the American Customer Satisfaction Index (ACSI) gains 1.9% to a score of 76.8 on a 100-point scale. The upswing follows a series of sharp drops that occurred between 2014 and 2015, and matches the previous high mark registered in the fourth quarter of 2013.

ACSI downturns followed immediately by upturns have occurred in the past, but they have usually been less pronounced. The most similar rebound in scope and magnitude occurred in 2005, and was followed by a period of prolonged growth in consumer satisfaction. Overall U.S. customer satisfaction reached an all-time high in the fourth quarter of 2013, and as a result, consumer spending in 2014 and 2015 grew at the highest annual levels since before the Great Recession.

“If we think about how customer satisfaction affects consumer spending, just visualize the standard demand diagram with quantity on the vertical axis and price on the horizontal axis,” says ACSI Chairman and founder Claes Fornell. “The demand curve in the diagram has a negative slope, which indicates how sensitive consumer demand is to an increase or decrease in price. Now, how does an increase in customer satisfaction come into play with respect to consumer demand? The answer is that it shifts the demand curve upwards, which means that demand increases if prices stay the same.”

Alternatively, prices can increase but have less of a negative effect on demand than had been the case if customer satisfaction had not increased. Since there is still very little evidence of inflation in most markets, consumer spending should increase. Furthermore, because consumers account for about two-thirds of the economy, the rate of GDP growth should increase as well.

To some extent, however, consumer spending is contingent on household discretionary income. Wage growth is now slightly better than it has been for a long time, and even though this growth might still be insufficient for significantly boosting spending, consumer confidence is high. This higher confidence, in turn, has led to a growing inclination among households to use a larger proportion of credit to finance consumption growth.

The sustained gains in customer satisfaction last year indicate stronger economic fundamentals for 2017. The stock market has reached all-time highs and the unemployment rate remains close to pre-Great Recession levels. If customer satisfaction stays strong, the incentive for consumers to spend will increase as well.

This press release is also available in PDF format.