Customer Satisfaction Declines Across Nondurable Products

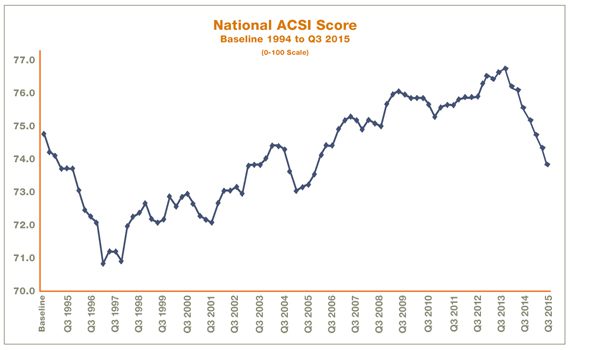

ANN ARBOR, Mich., (December 15, 2015) — The American Customer Satisfaction Index (ACSI) measure of overall customer satisfaction in the U.S. economy falls for a seventh consecutive quarter. The national ACSI score, measured in the third quarter of 2015, dips 0.7 percent to 73.8 on a 100-point scale. Since peaking in the fourth quarter of 2013, the national ACSI has fallen 3.9 percent, the longest stretch of deteriorating total customer satisfaction since 1996 to 1997.

“Without a turnaround in customer satisfaction, it’s hard to be optimistic about consumer spending growth,” says Claes Fornell, ACSI Chairman and founder. “The effect of languishing buyer satisfaction is usually due to a downward shift in demand curves, which shows up in weak consumer spending. Consumer demand is picking up, but not at a rate necessary to propel robust economic growth.”

The prospects for a surge in consumer spending necessary to provide a jolt to the economy seem highly unlikely. Though the economy added 211,000 jobs in November, the job participation rate so far this year is just below 63 percent and has not improved much in several years. Growth of the labor force itself is weak. Furthermore, job growth may be less of a response to increasing demand than to poor productivity.

The ACSI model predicts consumer spending growth of about 2.6 percent to 2.7 percent for the fourth quarter of 2015. This may well be the new “normal” growth rate, but it is only about half of what it was in the late 1990s. Since consumer spending represents about 70 percent of the economy, there is no reason to expect that the economy will grow at a better clip.

Nondurable Products

Customer satisfaction drops across all measured industries in the manufacturing/nondurable goods sector. Though overall inflation is low, food and beverage prices have increased, which is contributing to lower customer satisfaction with nondurable products. Nearly all companies score lower now compared with a year ago.

“Because of higher prices, consumers are spending a bit more on food items, and it is not clear if the continued weak wage increases and lower gas prices leave household disposable income intact,” says Fornell. “If not, there is less to spend on everything else.”

Food Manufacturing — At the top of food manufacturing, Dole ties longtime ACSI leader H.J. Heinz with a score of 81. Most of the industry is tightly grouped between 78 and 81. ConAgra, Kellogg, Mars and PepsiCo’s Quaker brand are deadlocked at 80. Campbell Soup, Hershey and Kraft register 79, followed by General Mills, Nestlé and Tyson at 78. As a whole, food manufacturing drops 3.8 percent to 76, largely as a result of a 10-percent plunge in the combined score of smaller food companies that make up the “all others” category at 69.

Beverages – The soft drink industry is under pressure from the changing palette of consumer tastes. As the bottled water market continues to surge and sweetened beverages fall out of favor, soft drink manufacturers are adjusting their portfolios. Soft drink companies fall 3.7 percent to 79, the lowest score ever. Coca-Cola and Dr Pepper Snapple share the lead at 79, followed by PepsiCo at 78. The group of smaller soft drink makers trails with a score of 74.

Brewers also are undergoing a major transformation as company consolidation continues. The beer industry comes in at an ACSI score of 76 after a 3.8-percent drop. MillerCoors leads with a score of 78, followed by the group of smaller breweries and microbrews at 76. Anheuser-Busch InBev rounds out the category at 74.

Personal Care and Cleaning Products – Customer satisfaction with everyday household items like soap, shampoo, detergents and other cleaning products declines 6.1 percent to an ACSI score of 77. Clorox (82) remains the top-scoring company for a fifth straight year. Unilever repeats at 80 and is one of only three companies in the sector to maintain its score. Not a single nondurables company improves its customer satisfaction this year. Colgate-Palmolive and Dial tie at 79, while Procter & Gamble shares last place with the smaller companies group (both 75).

Apparel and Athletic Shoes – Aside from Unilever, Nike and Adidas are the only nondurable manufacturers to hold customer satisfaction steady this year. Nike scores 78, while Adidas remains stable at 77. But the two largest athletic shoe companies are slightly behind the “all others” category (79), which includes Under Armour and Skechers. A decline for the smaller manufacturers pulls down the industry’s customer satisfaction by 2.5 percent to 78.

The apparel industry registers an ACSI score of 76, following a slip of 2.6 percent. Levi Strauss regains its perch at the top of the category with a score of 78. Nine West Holdings, which includes Jones New York brands, is next at 77. VF, which owns a range of brands such as Wrangler, JanSport and The North Face, comes in at the industry average (76), while Hanesbrands scores 74. The category of all smaller companies brings up the tail at 72, the lowest customer satisfaction level in apparel.

The third quarter national ACSI score is based on 14,042 customer surveys. The manufacturing/nondurable goods scores are based on 4,986 customer surveys collected in the third quarter of 2015.

This press release is also available in PDF format.