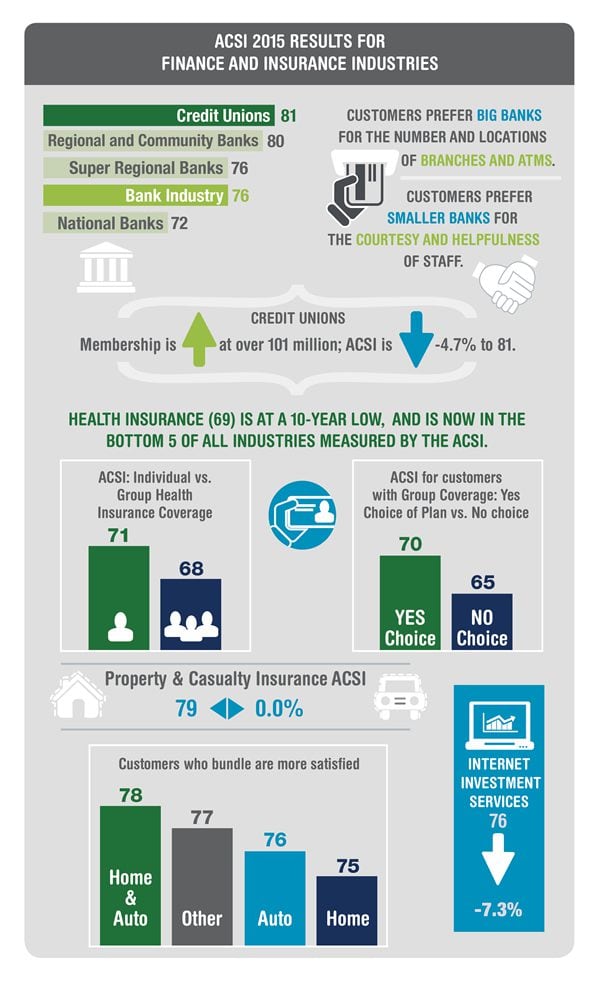

Credit Unions Feel Weight of New Members; Health Insurers Get Poor Grades; Market Volatility Hurts Internet Investment Services

ANN ARBOR, Mich., (November 17, 2015) – According to new data from the American Customer Satisfaction Index (ACSI), customer satisfaction with the finance and insurance sector continues its slide. The sector, which includes banks, credit unions, life insurance, health insurance and Internet investment services, falls 0.4 percent to 74.8 on ACSI’s 100-point scale, its lowest score in a decade.

“These are not happy times,” says Claes Fornell, ACSI Chairman and founder. “Insurance companies and credit unions are joining the troubling trend of deteriorating customer satisfaction that we’ve seen throughout most of the U.S. economy. Corporations facing increasing earnings and revenue pressure keep raising premiums and fees, which, combined with cost cutting to maintain profitability, is having a negative effect on service and on customer satisfaction. What might look good on the balance sheet in the short term is not helpful for long-term prosperity.”

Banks and Credit Unions

Customer satisfaction with banks is unchanged at an ACSI score of 76, despite cost cutting and rising fees for out-of-network ATMs. National banks earn an ACSI score of 72, significantly below the average for super regional banks (76), which are smaller than national banks, but still outsize regional and community banks. Among the largest national banks, the gap from top to bottom grows. Only Wells Fargo Bank improves, gaining 4 percent to an ACSI score of 75. The remaining three largest banks deteriorate as Citibank dips 1 percent to 73 and Chase retreats 4 percent to 71. Bank of America remains in last place among national banks, down 1 percent to 68.

Super regional banks are included in the ACSI by name for the first time this year, and the leaders of this group rank far ahead of their national counterparts. Regions Bank is the highest-scoring among super regionals at 79, just ahead of PNC Bank (78) and the duo of BB&T and Capital One (tied at 77). U.S. Bank matches the average of all banks at 76. Fifth Third Bank and TD Bank post matching scores of 75, while SunTrust Bank comes in at 74. Citizens Bank makes a lackluster debut at 70. Regional and community banks, measured in aggregate, are the highest-scoring category in retail banking at 80.

Meanwhile, credit unions are struggling to stay ahead of small banks amid an influx of new members. As credit union membership surpasses 101 million, customer satisfaction with credit unions is down 4.7 percent to 81, only a point ahead of regional and community banks.

“Smaller, more nimble companies that can provide a more personalized experience tend to perform better than large corporations,” says David VanAmburg, ACSI Director. “This has been the advantage for the credit union industry, which for years has led banks by a wide margin in ACSI. But as credit unions add large numbers of new members, they may struggle to maintain better service levels compared with traditional banks, particularly small community banks, which now nearly tie credit unions.”

ACSI data show that both smaller banks and credit unions provide similar service levels that far exceed large national banks across most elements of the customer experience—including staff courtesy, transaction speed, service variety and competitiveness of interest rates. National banks, by virtue of their size and resources, maintain an advantage in just two areas: number of branch locations and ATMs.

Insurance Industries

The Affordable Care Act has delivered millions of customers to health insurance companies, but the industry drops 1.4 percent to 69, among the bottom five industries measured by the ACSI and ahead of only ISPs and the pay TV industry. Many of these new customers hold individual policies that provide a minimum of coverage with high deductibles. Customer satisfaction for individual policy holders slumps 4 percent to 71, but consumers with group coverage are less happy (68). Among group policyholders, however, choice makes a difference. Those who are offered a choice of plans (70) are more satisfied than those without choice (65).

“More Americans get group coverage through their employer, where they typically do not have a choice of provider,” says VanAmburg. “As is generally the case, satisfaction is lower in industries where there is little or no choice.”

The aggregate of smaller health insurers drops 3 percent to tie new entrants Humana and Kaiser Permanente at 71, followed by Blue Cross and Blue Shield (+1% to 70), Anthem (+5% to 69) and Aetna (+5% to 68). UnitedHealth was the top-scoring large insurer only a year ago, but now comes in near the bottom of the category, tumbling 8 percent to 66. Cigna debuts in last place with an ACSI score of 60.

Customer satisfaction is unchanged at 79 for property and casualty insurance. Customers who bundle their auto and homeowners coverage together are more satisfied on average (78) than those purchasing only auto insurance (76) or homeowners (75). Smaller companies provide better service, as the aggregate of smaller insurers gains 5 percent to 83, followed by new entrant Farm Bureau at 80. Meanwhile, the nation’s biggest P&C insurer State Farm drops 4 percent to 78 and GEICO holds steady at 77.

The rest of the P&C industry is led by ACSI newcomers AAA and Nationwide, both tied at 75. Progressive is down 3 percent to 74, while Allstate falls 5 percent to 73. The remaining three new additions to the ACSI all come in at 73: American Family, Liberty Mutual and Travelers. Farmers registers the biggest decline, falling 8 percent to the bottom of the category at 71.

The life insurance industry slides 3.8 percent to 77, a second consecutive year of decline. New ACSI entrant Thrivent Financial takes the lead with a score of 82, followed by Primerica (81) and New York Life (+3% to 79).

Northwestern Mutual (+3% to 78) matches the average score for smaller life insurance companies, while Prudential (-3%) ties with life insurance newcomer Allstate at 77. Mutual of Omaha debuts at 76 and matches State Farm, which is measured in this category for the first time. The largest insurer in the country, MetLife, slips 1 percent to 75 and is tied with new ACSI entrant Lincoln Financial at the low end of the industry. Farmers, posting its first life insurance score, lags behind at 71.

Internet Investment Services

Internet investment services, which include online brokerages and investment research companies, plunge 7.3 percent to an ACSI score of 76. Market turmoil over the summer sparked a flurry of activity as investors tried to stay on top of volatility in stock prices, leaving some customers unable to access their trading accounts. Says VanAmburg, “Customer satisfaction with Internet investment services ebbs and flows with the market, but some companies do better than others regardless of market conditions.”

Two new entrants to the ACSI, Vanguard and Scottrade, debut at the top of the industry with scores of 80 and 79, respectively. Charles Schwab loses the top spot among the largest websites (-3% to 78) but still performs above the industry average, tying with newcomer Edward Jones. Fidelity is the only firm to improve (+1% to 77).

The decline for the industry overall is largely the result of weakened satisfaction with smaller brokerage sites, which dive 11 percent to a combined score of 76. E*Trade is down 3 percent to 74, and TD Ameritrade slips 1 percent to 73. In its first year of ACSI measurement, Bank of America’s Merrill Edge posts a score of 73.

The ACSI report, which is based on 9,202 customer surveys collected in the third quarter of 2015, is available for free download.

This press release is also available in PDF format.